Practice Valuation

Step 1: Valuation Framework & Guidelines

Structure & People

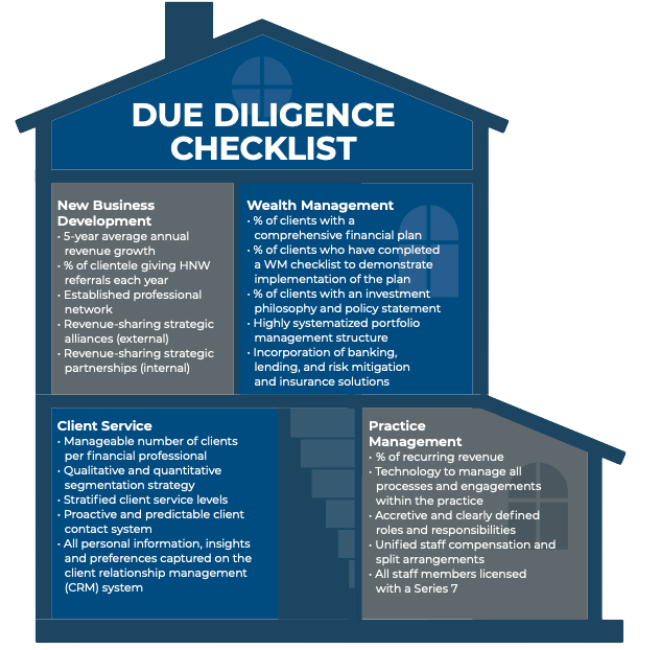

Your practice is composed of two components: structure and people. The more sound your balance sheet, the more systematic and repeatable your business processes. And the more sophisticated and cohesive your team is, the higher your ROI/ROA.

This first step is designed to help you quantify the strengths and weaknesses of your practice. This framework serves as a benchmark to help you prepare your practice for sale at the highest possible ROA. This framework will help your buyer pay an appropriate multiple, given the quality of your practice.

Is your house in order?

your practice has Four Rooms

-

Client Services

-

Practice Management

-

Wealth Management

-

New Business DevelopmenT

Your Practice's Rooms

Analyze the five variables below the 'rooms' to assess the quality and functionality of each in your practice. Keep in mind, these are guidelines designed to help you assess or evolve your practice to achieve highest valuation. There may be other variables you want to assess or create, given your unique practice and market.

Serve Clients

1. Manageable number of clients per financial professional

2. Qualitative & quantitative segmentation strategy

3. Stratified client service levels

4. Proactive & predictable client contact system

5. All personal information, insights & preferences captured on client relationship management (CRM) system

Manage Practice

1. % of recurring revenue

2. Technology to manage all processes & engagements within the practice

3. Clearly defined roles, responsibilities & growth paths

4. Unified staff compensation & split arrangements

5. All staff members hold Series 7 license

Manage Wealth

1. % of clients with a comprehensive financial plan

2. % of clients who have completed a WM checklist

3. % of clients with an investment philosophy & policy statement

4. Systematized portfolio management structure

5. Incorporation of banking, lending, & risk mitigation

Develop New Business

1. 5-year average annual revenue growth

2. % of clientele giving HNW referrals each year

3. Established professional network

4. Revenue-sharing strategic alliances (external)

5. Revenue-sharing strategic partnerships (internal)

Exercises & Tools

Downloadable Resources